Can I Deduct Health Insurance Premiums If I Am Retired

However if an employer only pays for part of your premiums you still may be able to claim a tax deduction for the portion you paid. But you can deduct only premiums that you pay with after tax money from your own pocket.

Are Health Insurance Premiums Tax Deductible The Motley Fool

Are Health Insurance Premiums Tax Deductible The Motley Fool

can i deduct health insurance premiums if i am retired

can i deduct health insurance premiums if i am retired is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i deduct health insurance premiums if i am retired content depends on the source site. We hope you do not use it for commercial purposes.

If your health insurance premiums are paid entirely by your employer or the government you cannot deduct the cost.

Can i deduct health insurance premiums if i am retired. If you didnt pay for health insurance you cant take a tax deduction for it. The 2018 penalty isnt tax deductible but some taxpayers can deduct the cost of the health insurance premiums they pay. You cant deduct the costs of toiletries or elective procedures that are not required to improve your health.

This tax perk was on the chopping block for a while as congress mulled over the provisions of the tax cuts and jobs act that went into effect in the tax year 2018. If your employer pays your health insurance premiums you cant deduct those costs. Eligibility depends on whether youre an employee or self employed and whether you paid for your insurance using pre tax dollars or post tax dollars.

Health care insurance premiums and other medical expenses that you paid with out of pocket funds are an eligible medical expense that you can deduct using schedule a for itemized deductions. You can deduct your health insurance premiums on your return if you paid for the premiums with after tax dollars. However self employed workers can deduct health insurance premiums as an above the line deduction on form 1040.

Yes in certain circumstances you can deduct your health insurance premiums as part of your overall medical expenses. Employees can claim medical expenses as deductions too including health insurance premiums. Medical expenses are an itemized deduction on schedule a and are deductible to the extent they exceed 10 of your adjusted gross income agi.

The rules for deducting health insurance premiums on taxes. When health insurance is not tax deductible. The law is the pension protection act.

To take this deduction total the health care premiums you paid during the year for yourself your spouse and dependents and use the self employed health insurance deduction worksheet. Youve retired but now your medical expenses are increasingthats a natural result of aging. However only your total medical expenses that are greater than 10 of your adjusted gross income agi can be deducted if you are under age 65.

It can also depend on whether you take the standard deduction or itemize. There are two types of health premium deductions affecting federal retirees and their health insurance. It was written to toughen federal standards for pension funding but it also includes a special tax break for retired public safety officers if you or your spouse used to work in law enforcement you may be able to claim a write off for health insurance premiums.

One is the itemized deduction that all taxpayers can claim for health insurance premiums on.

What You Need To Know About Dps Coverage Invest News Top

What You Need To Know About Dps Coverage Invest News Top

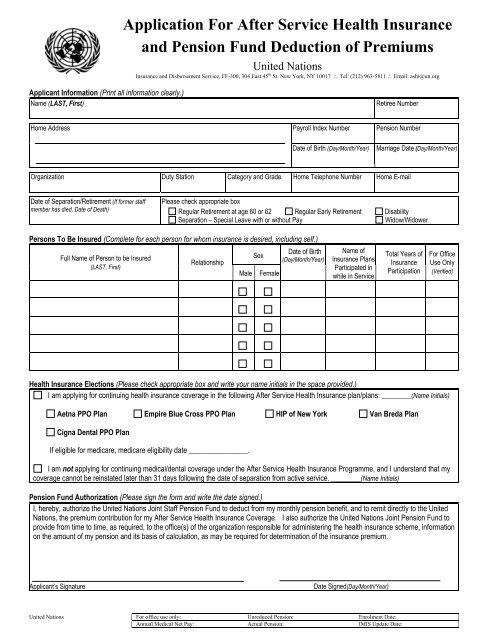

Application For After Service Health Insurance And Pension Fund

Application For After Service Health Insurance And Pension Fund

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is

Self Employed Medicare Retiree Box 5 On 1099 R Is Empty Is

Claiming The Self Employment Health Insurance Tax Deduction

Claiming The Self Employment Health Insurance Tax Deduction

Deducting Health Insurance Premiums Health Care Expenses On Your

Deducting Health Insurance Premiums Health Care Expenses On Your

How To Cover Medical Expenses If You Retire Before 65

How To Cover Medical Expenses If You Retire Before 65

/GettyImages-565954727-56fdc9b05f9b586195e2452d.jpg) What Medical Costs Are Tax Deductible For Retirees

What Medical Costs Are Tax Deductible For Retirees

Universal Life Insurance How It Fits Into Your Legacy Planning

Universal Life Insurance How It Fits Into Your Legacy Planning

The Most Important Health Insurance Chart You Ll Ever See The

The Most Important Health Insurance Chart You Ll Ever See The

The Most Important Health Insurance Chart You Ll Ever See The

The Most Important Health Insurance Chart You Ll Ever See The

How To Build A Competitive Employee Benefits Package Inc Com

How To Build A Competitive Employee Benefits Package Inc Com