Can Hsa Be Used For Health Insurance Premiums

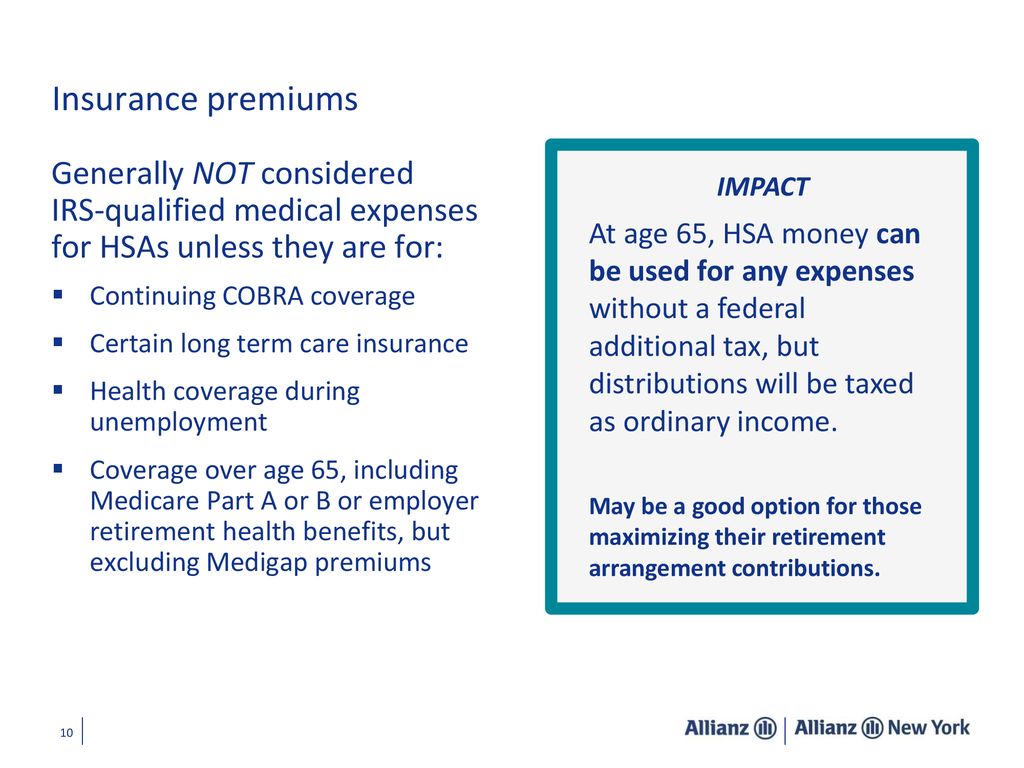

How to pay for premiums with hsa. While you can use hsa money to pay for a variety of medical and dental services and procedures you generally cant use it to pay premiums for health insurance.

Pay Health Insurance Premiums From Health Savings Account

can hsa be used for health insurance premiums

can hsa be used for health insurance premiums is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can hsa be used for health insurance premiums content depends on the source site. We hope you do not use it for commercial purposes.

While it is possible this law will change in the future currently it is not the case.

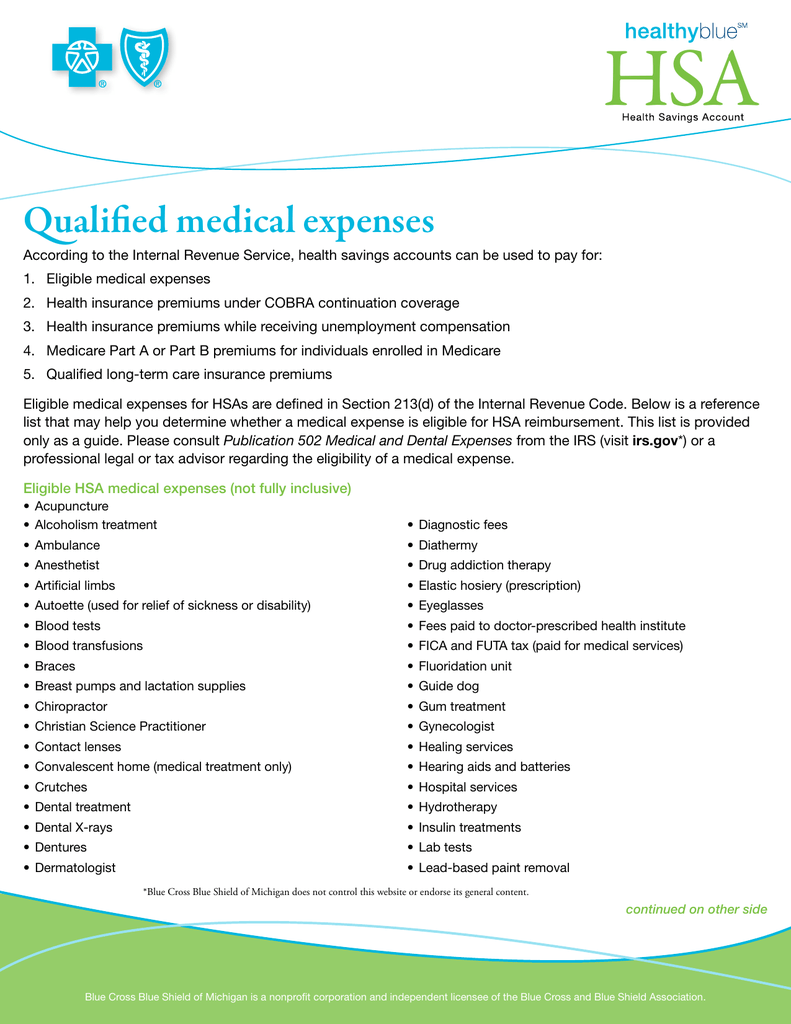

Can hsa be used for health insurance premiums. The expenses must be primarily to alleviate or prevent a physical or mental defect or illness including dental and vision. See our list of qualified hsa expenses or refer to irs form 502 for more information. You can only use your hsa to pay health insurance premiums if you are collecting federal or state unemployment benefits or you have cobra continuation coverage through a former employer.

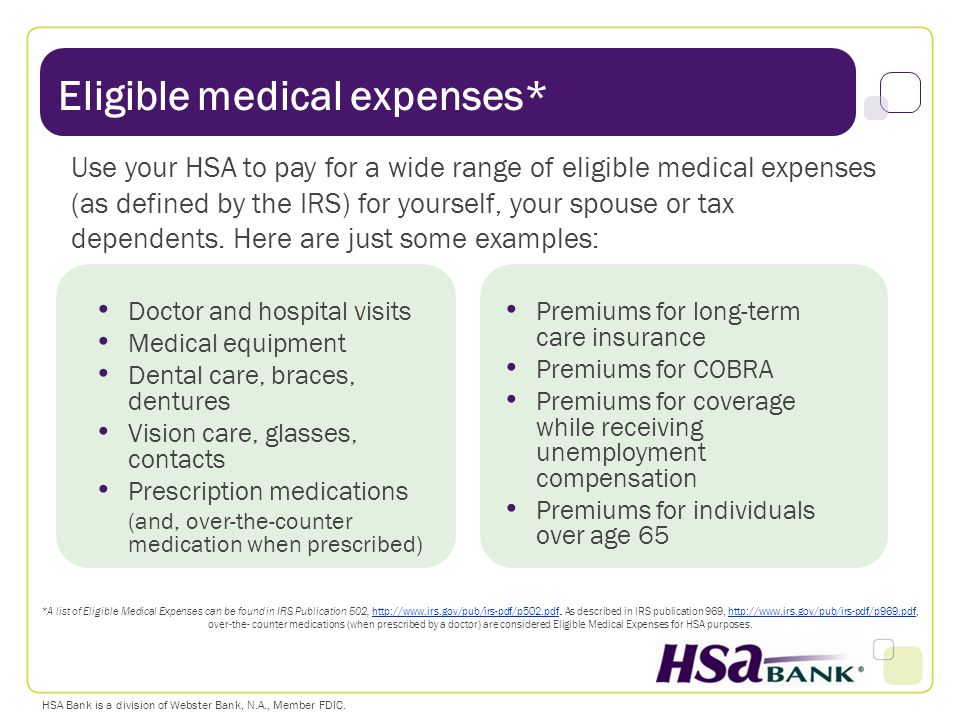

At a time when insurance premiums are on the rise everyone is looking for a way to stretch their health care dollar. Health savings accounts help by providing a way to pay for qualified medical expenses with tax free dollars. Funds you withdraw from your hsa are tax free when used to pay for qualified medical expenses as described in section 213d of the internal revenue service tax code.

However there are only a few situations in which you can use hsa money to pay insurance premiums. The answer is yes in some cases. But did you know that your hsa can be used to cover health expenses in retirement.

The money you contribute to an hsa plan rolls over even if you no longer have the associated health plan so its an effective way to save for future costs. One popular inquiry is whether money from a health savings account hsa can be used to cover insurance premiums. Health insurance is a top priority for most of us but premiums and out of pocket medical bills can leave your wallet thinner.

It is unfortunate that hsa funds cannot be used for insurance premiums except in extenuating circumstances involving job loss. For b and c above your hsa can be used for your spouse or a dependent meeting the requirement for that type of coverage. There are some exceptions however.

You cant use money from a flexible spending account to pay cobra health insurance premiums but you can tap money in a health savings. For d above if you the account beneficiary are not 65 years of age or older medicare premiums for coverage of your spouse or a dependent who is 65 or older generally are not considered a qualified medical expenses. A health savings account or hsa lets you put aside money for medical expenses while taking a tax deduction for the contributions you make to the account.

These plans generally have lower premiums than other policies and enable you to use a health savings account hsa to pay out of pocket expenses ordinarily they cant be used for insurance. The more you understand your hsa the. If you are currently paying into an hsa and.

Can i contribute to both an hsa and an fsa. Even so the rules for paying insurance premiums while unemployed are strict.

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Hsa Overview Overview Hsa What Does It Stand For Health Savings

Hsa Overview Overview Hsa What Does It Stand For Health Savings

Comparison Of Health Savings Accounts Hsas And Flexible Spending

Comparison Of Health Savings Accounts Hsas And Flexible Spending

Winning With An Hsa Pages 1 8 Text Version Fliphtml5

Winning With An Hsa Pages 1 8 Text Version Fliphtml5

Hsa Qualified Medical Expenses

Hsa Qualified Medical Expenses

State Should Adopt Health Savings Accounts Mackinac Center

Health Savings Account Human Resource Services

Find Out What A Health Savings Account Can Do For You Ppt Video

Find Out What A Health Savings Account Can Do For You Ppt Video

Are Health Insurance Premiums Tax Deductible Health Insurance

Are Health Insurance Premiums Tax Deductible Health Insurance

Health Care Costs Options Before And After Retirement Ppt Download

Health Care Costs Options Before And After Retirement Ppt Download

Health Savings Accounts Hsas 4 Team Nash

Health Savings Accounts Hsas 4 Team Nash